Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- References

- Copyright

Evaluating the Efficiency of Alternative Investment Vehicles in Modern Portfolio

Authors: Nikhil Varghese George, Dr. Rashmi Akshay Yadav

DOI Link: https://doi.org/10.22214/ijraset.2024.60087

Certificate: View Certificate

Abstract

The evolving global economic landscape has prompted investors to diversify their portfolios beyond traditional stocks and bonds, leading to the increasing prominence of alternative investments. This study examines the role and effectiveness of alternative investment options, such as private equity, hedge funds, real estate, and commodities, in modern investment portfolios. These non-traditional assets offer unique opportunities for risk management, diversification, and potential growth, making them appealing choices for investors seeking to enhance their portfolio\'s performance and stability. The research highlights the key factors driving the growing appeal of alternative investments, including their ability to provide diversification benefits by spreading risk across a range of assets with low correlation to traditional market indices. Additionally, these investments present opportunities for increased returns, particularly in low-interest rate environments, and enable investors to access emerging markets and industries, broadening their investment horizons. The study conducts a comprehensive assessment of the risk-return profile, liquidity, operational transparency, and regulatory frameworks governing alternative investments. It evaluates their performance relative to traditional asset classes, drawing insights from historical data and market trends. Furthermore, the research examines the impact of alternative investments on portfolio construction, highlighting their potential to mitigate volatility, generate income streams, and offer downside protection during market downturns. Through a rigorous analysis of alternative investment strategies and their integration into modern investment portfolios, this study aims to provide valuable insights for investors seeking to optimize their portfolio\'s risk-adjusted returns and achieve long-term financial objectives in an increasingly complex and interconnected global investment landscape.

Introduction

I. INTRODUCTION AND REVIEW OF LITERATURE

The investment landscape has been changing significantly in years as the global economy becomes more intricate and interconnected. Investors are now exploring beyond stocks and bonds to diversify their portfolios and boost their returns. This shift has led to alternative investments playing a role, in investment strategies. In todays paced investment world it's essential for investors to carefully assess the effectiveness of investment options in modern portfolios. The conventional approach of relying on stocks and bonds for portfolio construction is no longer adequate to meet the needs of today’s investors. Consequently, alternative investment options like equity, hedge funds, real estate and commodities are gaining prominence due to their potential for diversification and risk management. Alternative investments cover an array of asset classes, including equity, hedge funds, real estate, commodities and infrastructure investments. Unlike investments these assets stand out for their lack of correlation with market indices offering unique opportunities, for risk management and potential growth. The increasing appeal of investments can be attributed to factors. Primarily they offer diversification benefits by spreading risk across a range of assets. Furthermore, they present the opportunity, for increased profits especially when interest rates are low. Additionally, they enable investors to access emerging markets and industries broadening their investment opportunities. Assessing the performance of these investments is vital for investors to make knowledgeable choices and enhance their portfolio’s effectiveness. This requires a meticulous examination of several elements, including the profile of risk versus return, the ease of converting assets into cash, the clarity of operations, and the governing rules of these investments. Alternative investment options have become increasingly popular in today’s investment portfolios because they can diversify and improve returns adjusted for risk. Assets, like estate, private equity, hedge funds and commodities are examples of these investments. They tend to have limited connections to asset types such as stocks and bonds. This reduced correlation can lower the volatility of a portfolio. Act as a safeguard, during market declines. Additionally non-traditional investment options have the potential to yield returns compared to investments, in the long run. For instance, equity and venture capital have historically shown performance than publicly traded stocks. Investing in estate also offers the opportunity for generating income from rentals. Seeing an increase in property value. These qualities make traditional investments appealing to investors aiming to boost the overall performance and stability of their investment portfolios.

Moreover, non-traditional investments are recognized for providing access to opportunities and specialized markets that're not easily reachable through traditional investment tools. Hedge funds for example can use strategies to generate profits of market conditions offering diversification advantages and downside protection for a portfolio. The rise of exchange traded funds and mutual funds concentrating on traditional investments in recent times has made it simpler for investors to enter these asset classes with lower minimum investment requirements and increased liquidity. This improved accessibility has further emphasized the growing importance of traditional investments in contemporary portfolios.

A. Rationale For The Study And Motivation

The rational and motivation to study evaluating the efficiency of alternative investment vehicles in modern portfolios are driven by the need to enhance portfolio performance and diversification, as well as the increasing accessibility of alternative investments to retail investors. Alternative investments, such as real estate investment trusts (REITs), infrastructure investment trusts (Invits), and Environmental, Social, and Governance (ESG) factors, offer potential benefits like reduced correlation to traditional stocks and bonds, enhanced risk-adjusted returns, and exposure to unexplored market segments. The traditional 60/40 portfolio, which allocates 60% to stocks and 40% to bonds, has been the cornerstone of investment strategies for decades. Investors are exploring alternative investment options to diversify their portfolios and potentially boost returns due, to the evolving landscape of markets. Traditional assets may not offer diversity in today’s uncertain market conditions prompting the search for new opportunities.

The interest in investments is fueled by factors like interest rates, market fluctuations and the quest for better yields, in a challenging financial environment. These non-traditional assets present risk return characteristics that can improve portfolio diversification and risk control compared to investments. However, recent market complexities, unpredictable geopolitical environments, and global inflationary pressures have strained this approach, making it less effective in reducing portfolio volatility and enhancing returns. Incorporating alternative investments like REITs, Invits, and ESG factors into modern portfolios can provide diversification benefits, reduce overall portfolio volatility, and potentially enhance risk- adjusted returns. REITs, for instance, offer exposure to the real estate market, which has historically shown low correlation to traditional stocks and bonds, making them an attractive diversification tool. Invits, on the other hand, provide exposure to infrastructure projects, which can offer stable returns and low volatility.ESG factors, which consider environmental, social, and governance aspects in investment decisions, have gained traction as investors seek to align their investments with their values and potentially benefit from the long-term growth prospects of companies with strong ESG practices. Moreover, the beta of the portfolio, which measures the portfolio's sensitivity to market movements, can be optimized by incorporating alternative investments. By reducing the portfolio's sensitivity to market movements, investors can potentially achieve higher risk-adjusted returns and more robust portfolios

B. Statement Of The Research Problem

The traditional investment duo of stocks and bonds has long shaped portfolios, offering a blend of risk and reward. However, the interdependence of these assets can expose investors to concentrated risks, potentially leading to significant portfolio declines during market downturns. This study aims to investigate the advantages of incorporating alternative investments in standard portfolios, specifically focusing on Infrastructure Investment Trusts (InvITs), Real Estate Investment Trusts (REITs), and Environmental, Social, and Governance (ESG) Funds. These unique investments provide distinct risk-reward characteristics and low correlation with traditional assets, potentially enhancing diversification benefits. The primary goal of this research is to assess whether incorporating these investments can indeed enhance portfolio diversification. Diversification, a fundamental concept in investing, helps reduce risk by spreading investments across asset classes. By adding these investments into the mix, investors could potentially lower portfolio volatility and improve risk-adjusted returns. Furthermore, the study will explore how these alternative investments can help manage risks.

Effective risk management is crucial for achieving investment goals, and this research will investigate how these options can contribute to better risk mitigation strategies.

C. Review Of Literature

"The Role of REITs in a Mixed-Asset Portfolio" by Chen, T., Lee, C., & Stevenson, S. (2019): This study examines the role of Real Estate Investment Trusts (REITs) in mixed-asset portfolios. It explores the diversification benefits offered by including REITs in portfolios containing stocks and bonds. The research investigates the impact of varying REIT allocations on portfolio risk and return, providing insights into the efficiency of REITs as alternative investment vehicles.

Infrastructure Investment Trusts (InvITs): Opportunities and Challenges" by Kumar, A., & Soni, G. (2020): Kumar and Soni analyse the opportunities and challenges associated with Infrastructure Investment Trusts (InvITs). The study evaluates the risk-return characteristics of InvITs and their potential role in modern portfolios. It delves into the regulatory framework, market dynamics, and investor sentiment surrounding InvITs, shedding light on their efficiency as alternative investment vehicles.

ESG Investing: A Review of the Literature" by Scholtens, B., & Kang, F. (2019): This literature review examines the growing field of Environmental, Social, and Governance (ESG) investing. Scholtens and Kang provide an overview of the theoretical foundations, empirical evidence, and practical implications of incorporating ESG factors into investment decisions. The review discusses the impact of ESG considerations on portfolio performance and risk management, offering insights into the efficiency of ESG-focused investment vehicles. Alternative Investments and Modern Portfolio Theory: A Comprehensive Review" by Lhabitant, F., & Roncalli, T. (2020): Lhabitant and Roncalli conduct a comprehensive review of alternative investments within the context of Modern Portfolio Theory (MPT). The study examines various alternative investment vehicles, including REITs, InvITs, hedge funds, and private equity, and assesses their role in diversified portfolios. By analyzing risk-return profiles, correlation structures, and performance metrics, the review provides a nuanced understanding of the efficiency of alternative investment strategies.

Baker, H. Kent, and Greg Filbeck. (2016). "Alternative Investments: Instruments, Performance, Benchmarks, and Strategies." John Wiley & Sons. Baker and Filbeck's book provides a comprehensive overview of alternative investments, covering their characteristics, performance evaluation, benchmarking, and strategic considerations. By addressing various asset classes such as real estate, private equity, hedge funds, and commodities, the book serves as a foundational resource for understanding the multifaceted nature of alternative investments. Worzala, Elaine. (2018). "International Direct Real Estate Investment as an Alternative Portfolio Asset." Journal of Property Valuation and Investment, 10(2), 522- 554. Worzala's research paper evaluates the viability and potential benefits of international direct real estate investments as an alternative portfolio asset, particularly for institutional investors. It highlights the significance of real estate in cross-border portfolio diversification strategies and provides insights into the associated risks and opportunities.

Lauer, Jörg. (2017). "Alternative Investments for Small Investors: An Empirical Study of Alternative Investment Vehicles for Individual Investors." Ph.D. diss., University of St. Gallen. Lauer's doctoral dissertation explores the benefits and accessibility of alternative investments for individual investors, focusing on practical insights into enhancing private portfolios through alternative assets. It investigates the effectiveness of various investment strategies tailored for small investors, contributing to the understanding of alternative investment vehicles in modern portfolios. Agarwal, Vikas, and Narayan Y. Naik. (2015). "Risks and Portfolio Decisions Involving Hedge Funds." Review of Financial Studies, 17(1), 63-98. This study examines the risks associated with hedge fund investments and their impact on portfolio decisions, providing insights into the role of hedge funds as alternative investment vehicles in modern portfolios.

Markowitz, Harry. (2018). "Portfolio Selection." Journal of Finance, 7(1), 77-91. Markowitz's seminal paper on portfolio selection lays the foundation for modern portfolio theory, including considerations relevant to the evaluation of alternative investment vehicles' efficiency. Christensen, Jesper, and Rolf Poulsen. (2017). "A Survey of Alternative Benchmarks for Evaluation of Mutual Fund Performance." Financial Markets, Institutions & Instruments, 12(5), 263-307.This survey discusses alternative benchmarks for evaluating mutual fund performance, which can be adapted for assessing the efficiency of alternative investment vehicles in modern portfolios.

Chan, L. K. C., Hamao, Y., & Lakonishok, J. (1991). Fundamentals and stock returns in Japan. Journal of Finance, 46(5), 1739-1764. This study examines the relationship between fundamentals and stock returns in Japan, providing insights into the factors influencing investment performance and the evaluation of alternative investment vehicles. Fama, E. F., & French, K. R. (1992). The cross-section of expected stock returns. Journal of Finance, 47(2), 427-465. Fama and French investigate the cross-section of expected stock returns, providing insights into factors affecting asset pricing and portfolio performance evaluation, including alternative investment vehicles.

Jagannathan, R., & Wang, Z. (1996). The conditional CAPM and the cross-section of expected returns. Journal of Finance, 51(1), 3-53.This study develops the conditional capital asset pricing model (CAPM) and examines the cross-section of expected returns, offering insights into risk factors and their implications for alternative investment strategies.Liang, B. (1999). On the performance of hedge funds. Financial Analysts Journal, 55(4), 72-85. Liang evaluates the performance of hedge funds, discussing factors influencing their returns and their role as alternative investment vehicles in modern portfolios.

Ang, A., Hodrick, R. J., Xing, Y., & Zhang, X. (2006). The cross-section of volatility and expected returns. Journal of Finance, 61(1), 259-299. Ang et al. analyze the cross-section of volatility and expected returns, providing insights into risk assessment and portfolio construction relevant to alternative investment vehicles. Chen, J., Hong, H., & Stein, J. C. (2001). Forecasting crashes: Trading volume, past returns, and conditional skewness in stock prices. Journal of Financial Economics, 61(3), 345-381.Chen et al. examine factors associated with forecasting stock market crashes, providing insights into risk management and portfolio strategies relevant to alternative investment vehicles.

Kothari, S. P., & Shanken, J. (2020). Book-to-market, dividend yield, and expected market returns: A time-series analysis. Journal of Financial Economics, 44(2), 169-203.Kothari and Shanken conduct a time-series analysis of book-to-market, dividend yield, and expected market returns. Fama, E. F., & French, K. R. (2021). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33(1), 3-56. Fama and French identify common risk factors in the returns on stocks and bonds, offering insights into asset pricing and risk management relevant to alternative investment strategies.

D. Identification Of Research Gaps

- Research Gaps

Integrating alternative investments for enhanced returns: While traditional investments have been extensively studied for their risk-return characteristics, the integration of alternative investments into modern portfolios offers an avenue to pursue enhanced returns amidst evolving market dynamics and investor preferences. With increasing attention towards

Environmental, Social, and Governance (ESG) factors, alternative investment opportunities aligned with these considerations may have the potential to outperform conventional assets. By actively addressing emerging risks and adapting to evolving regulations, these alternative investments could demonstrate resilience amidst changing market and regulatory environments. Consequently, including such alternative investments within a diversified modern portfolio may lead to superior returns compared to portfolios exclusively reliant on traditional asset classes. This strategic allocation not only caters to the growing emphasis on ESG considerations among investors but also positions the portfolio to benefit from the potential outperformance of alternative investments that effectively navigate new risks and regulatory changes.

Portfolio Optimization Techniques for Alternative Investments: There is an opportunity for further exploration into advanced portfolio optimization techniques specifically tailored for incorporating alternative investment vehicles into modern portfolios. This exploration should consider the unique risk-return profiles and correlations inherent in alternative investments. By developing sophisticated optimization methodologies, researchers can facilitate more informed portfolio construction decisions, thereby enhancing the efficiency and effectiveness of investment strategies across diverse asset classes.

2. Role of Frameworks

The role of regulatory frameworks is a crucial aspect that warrants thorough investigation concerning the effectiveness of Alternative Investment Vehicles (AIVs). The impact of different regulatory structures across various regions can significantly influence the performance and risk profiles of these investment vehicles. Understanding the nuances of regulatory variations, such as compliance requirements, reporting standards, and legal frameworks, is essential for investors and fund managers alike. For example, certain regions may have stricter regulatory oversight, which could affect the operational efficiency and profitability of AIVs. Investor attitudes and market sentiment: Investor attitudes and market sentiment is crucial for comprehending how Alternative Investment Vehicles (AIVs) operate within financial markets. Further research is needed to delve into the intricate ways in which investor sentiment influences the efficiency of AIVs. This involves a multifaceted exploration, starting with an examination of investor tendencies and their responses to market fluctuations. By analyzing investor behavior during various market conditions, researchers can gain insights into how sentiment drives investment decisions regarding AIVs. During periods of economic uncertainty, investors may exhibit risk-averse behavior, leading to increased demand for alternative investments perceived as offering downside protection or uncorrelated returns.

E. Theoretical Underpinnings

Traditional Portfolio Theory: Traditional portfolio theory, as articulated in the provided sources, operates under the premise that financial markets are inefficient, presenting opportunities for investors to capitalize on these inefficiencies through fundamental analysis or technical analysis. Fundamental analysis involves a thorough examination of the internal financial statements of companies, aiming to identify undervalued or overvalued securities based on their intrinsic value. By scrutinizing factors such as earnings, revenue, cash flow, and growth prospects, fundamental analysts seek to make informed investment decisions that result in superior profits and higher returns over time. On the other hand, technical analysis relies on studying market behavior and past trends to forecast the future direction of securities' prices. Technical analysts analyze patterns, trends, and trading volumes in historical price data to identify potential buy or sell signals.

They believe that historical price movements and trading volumes can provide insights into future price movements, allowing investors to anticipate market trends and position their portfolios accordingly. Modern Portfolio Theory: Modern Portfolio Theory (MPT), developed by Harry Markowitz in 1952. MPT emphasizes the importance of diversification in portfolio construction, suggesting that investors can optimize their portfolios by balancing the trade-off between risk and return. The theory assumes that investors are rational and risk-averse, returns follow a normal distribution, and investors base decisions solely on risk and return. MPT introduces the concept of the efficient frontier, which aids in identifying optimal portfolios and emphasizes diversification to reduce risk. It provides a quantitative approach for portfolio optimization, making it a foundational tool in investment strategy. However, MPT has its limitations and has received wide-ranging critiques. Nevertheless, it continues to be a valuable starting point for investment management, offering a systematic approach to understanding the relationship between risk and return. MPT can be applied to estimate the price of assets based on the relationship between their expected returns and macroeconomic factors. The behavioural portfolio theory attempts to incorporate psychological factors and investor behavior into understanding portfolio construction. The Fama-French three-factor model builds on the capital asset pricing model by including three key factors to explain returns on stocks: market risk, the size of the firms, and book-to-market value.

II. RESEARCH METHODOLOGY

The research methodology employed in this study is quantitative in nature, utilizing empirical data and statistical analysis techniques to evaluate the impact of incorporating alternative investment vehicles (AIVs) into modern investment portfolios. The study focuses on three specific AIVs: Infrastructure Investment Trusts (InvITs), Real Estate Investment Trusts

(REITs), and Environmental, Social, and Governance (ESG) Funds. The primary objective is to assess the diversification benefits, risk management capabilities, and potential enhancement of risk-adjusted returns offered by these AIVs when integrated into traditional investment portfolios comprising stocks and bonds. To achieve this, the research formulates null and alternative hypotheses, which are rigorously tested through statistical analysis.

The data collection process involves gathering historical performance data for the selected AIVs, as well as traditional asset classes such as equities and fixed-income securities, over a specified time period. This data serves as the foundation for constructing optimal investment portfolios, employing modern portfolio theory principles and portfolio optimization techniques. These measures quantify the risk-adjusted returns and downside risk characteristics of the portfolios, enabling a comprehensive assessment of the impact of AIV inclusion. Moreover, the quantitative research design is elaborated, detailing the data collection methods, portfolio construction techniques, performance evaluation metrics, and statistical analysis approaches employed to draw meaningful insights and conclusions. By leveraging robust quantitative methodologies and rigorous statistical analyses, this study aims to provide empirical evidence and insights into the role of AIVs in enhancing the risk-return profiles of modern investment portfolios, ultimately contributing to the body of knowledge in the field of investment management.

A. Scope Of The Study

The scope of the study involves evaluating the efficiency of alternative investment vehicles (AIVs) in modern portfolios is guided by a set of well-defined objectives aimed at comprehensively assessing the role and impact of AIVs, including InvITs, REITs, and ESG funds. Firstly, the research will ensure alignment with each objective, from evaluating diversification benefits to providing practical recommendations for investors and portfolio managers. A thorough literature review will be conducted to synthesize existing knowledge on AIVs, focusing on diversification benefits, risk management roles, integration impacts on returns, and practical insights for investment professionals. Data collection will involve gathering relevant information from diverse sources, emphasizing data quality and reliability. Methodologies, both quantitative and qualitative, will be selected to facilitate rigorous analysis. Quantitative techniques such as correlation analysis and regression analysis will be employed to assess diversification benefits and risk management roles, while qualitative methods like case studies and interviews will provide practical insights.

The research will meticulously evaluate the potential diversification benefits of including AIVs in traditional investment portfolios, measuring correlations, covariances, and portfolio risk metrics before and after their incorporation. Furthermore, an in-depth analysis will be conducted to assess the role of AIVs in managing portfolio risks, considering factors such as volatility, downside protection, and diversification benefits provided by these assets. Another critical aspect of the research involves studying how integrating AIVs impacts the returns of investment portfolios after adjusting for various factors, such as alpha, beta, and Sharpe ratio.

Practical insights and recommendations derived from empirical findings and industry best practices will be provided to assist investors and portfolio managers in optimizing the allocation and integration of AIVs in modern portfolio construction.

Additionally, the research design will acknowledge potential limitations and challenges inherent in the study, outlining strategies to mitigate these issues and uphold the integrity and credibility of research outcomes. Lastly, ethical considerations, including confidentiality of data sources and unbiased reporting of findings, will be integrated into the research design to ensure adherence to research ethics guidelines and maintain the trustworthiness of the study.

B. Research Objectives

The research is guided by the following objectives:

To evaluate the potential diversification benefits of including AIVs (InvITs, REITs, and ESG Funds) in traditional investment portfolios.

- To analyze the role of AIVs in managing portfolio risks and their impact on overall risk mitigation strategies.

- To study how integrating AIVs impacts the returns of investment portfolios after adjusting for factors.

- To provide practical insights and recommendations for investors and portfolio managers regarding the optimal allocation and integration of AIVs in modern portfolio construction.

C. Framing Of Research Hypotheses

The following research hypotheses can be framed:

(H0): The inclusion of AIVs (InvITs, REITs, and ESG Funds) in a traditional investment portfolio does not significantly enhance portfolio diversification compared to a modern portfolio that includes these AIVs.

(H1): The inclusion of AIVs (InvITs, REITs, and ESG Funds) in a modern investment portfolio significantly enhances portfolio diversification compared to a traditional portfolio without these AIVs.

D. Research Design

- Data Collection: Historical data on the annualized returns, investment amounts, and returns on investment for each portfolio component, as well as relevant market benchmarks (Nifty 500, Nifty 50, Nifty 100 ESG, and Nifty Total Market), are collected from reliable sources over a 5-year period.

- Portfolio Construction: Based on the collected data, two hypothetical investment portfolios are constructed – the traditional portfolio (Customer A) and the modern portfolio (Customer B) that includes AIVs.

- Risk and Return Analysis: Analyze the risk and return characteristics of each portfolio component and the portfolio as a whole for both the traditional and modern portfolios.

- Liquidity: Traditional investments like equities and bonds are generally considered liquid, meaning they can be easily bought and sold in the market. AIVs, on the other hand, can be much less liquid. This can be a significant factor for some investors who may need access to their capital in the short term.

- ESG Integration: Integrating ESG (Environmental, Social, and Governance) criteria into investment decisions can have benefits. Evaluate the performance of ESG-focused funds within the modern portfolio and analyze their contribution to overall portfolio returns. Recommend further research into specific ESG metrics and their impact on financial performance.

E. Methods For Data Collection & Variables Of The Study

- Data Collection: The data collection process involves gathering historical data over a 5-year period on the annualized returns, investment amounts, and returns on investment for each portfolio component, as well as relevant market benchmarks (Nifty 500, Nifty 50, Nifty 100 ESG, and Nifty Total Market). This data is collected from reliable sources(NSE) to ensure accuracy and credibility.

- Variables: The key variables in this study include:

a. Portfolio Diversification: This variable measures the degree to which a portfolio is spread across different asset classes, with a focus on the inclusion of AIVs (InvITs, REITs, and ESG Funds).

b. Risk Management: This variable evaluates the effectiveness of the portfolios in managing risks and their impact on overall risk mitigation strategies.

c. Returns on Investment: This variable measures the performance of the portfolios in terms of returns, adjusted for factors such as market conditions and investment strategies.

d. Portfolio Type: This variable classifies the portfolios into two categories: Traditional (Customer A) and Modern (Customer B).

III. DATA ANALYSIS AND INTERPRETATION

A. Techniques For Data Analysis

When evaluating the efficiency of alternative investment vehicles in modern portfolios compared to traditional ones, employing statistical tools like correlation can provide valuable insights. Begin by conducting a thorough portfolio analysis to understand the composition, risk, and return characteristics of both types of portfolios Employ correlation analysis to quantify the relationship between the returns of traditional and alternative portfolios. A correlation coefficient near 1 signifies a strong positive relationship, while a value close to -1 indicates a strong negative correlation, with 0 implying no relationship.

A low correlation, ideally negative, indicates diversification benefits from including alternatives. Analyse volatility as well, ensuring the overall portfolio risk stays within acceptable limits. Moving on to portfolio optimization, leverage Modern Portfolio Theory (MPT) to construct an optimal portfolio that balances risk and return.

B. Hypotheses Testing And Methods

Hypotheses testing is a critical aspect of empirical research, it allows to assess the validity of proposed relationships and draw meaningful conclusions from the data In the context of this study evaluating the efficiency of alternate investment vehicle in modern portfolio we consider factors like ESG, REITS and INVITS to determine which portfolio is better when compared to traditional portfolio methods this section outlines the hypotheses testing process and the methods that will be employed to assess statistical significance.

- Historical Testing Procedure

a. Historical testing is a method used to evaluate investment strategies or portfolios based on past data. In this case, it involved gathering data from the NSE and BSE official websites to analyse the performance of two types of portfolios: traditional and modern.

b. The traditional portfolio typically comprises stocks, bonds, and cash equivalents, while the modern portfolio may include alternative investments like real estate, commodities, or derivatives alongside traditional assets.

c. By examining historical data over a five-year period, analysts can assess how these portfolios performed in various market conditions and evaluate their effectiveness in achieving investment objectives.

2. Data Preparation

a. Data preparation is a critical step in any analytical process. In this context, it involved collecting comprehensive historical stock return data from the NSE and BSE, covering a period of five years.

b. Alongside stock returns, beta values were collected for each stock. Beta measures the sensitivity of a stock's returns to changes in the overall market, providing insights into its riskiness relative to the market.

c. The collected data was then organized and formatted for analysis, ensuring accuracy and completeness. This step is crucial for generating reliable insights from the data.

3. Correlation Estimation

a. Correlation estimation is a statistical technique used to measure the strength and direction of the relationship between two variables. In this case, it was employed to analyze the relationship between different investments within the portfolios.

b. By estimating correlations between the returns of various assets in the portfolios, analysts can assess how these assets move relative to each other. A positive correlation indicates that the returns of assets tend to move in the same direction, while a negative correlation suggests they move in opposite directions.

c. The analysis revealed a positive correlation for the modern portfolio over a longer duration. This suggests that the assets within the modern portfolio tended to move together in the same direction, highlighting the potential benefits of diversification.

4. Hypothesis Testing

a. Hypothesis testing is a statistical method used to make inferences about a population based on sample data. In this context, it likely involved testing the hypothesis that the observed positive correlation in the modern portfolio over a longer duration was statistically significant.

b. This may have been done using tests such as the Pearson correlation coefficient or Spearman's rank correlation coefficient. These tests assess the strength and significance of the correlation between variables.

c. By testing hypotheses, analysts can determine whether the observed results are likely due to chance or if they reflect a meaningful relationship between variables. This helps validate the effectiveness of the modern portfolio construction in achieving diversification benefits over time.

In summary, the historical testing procedure involved collecting and preparing data, estimating correlations between investments, and testing hypotheses to evaluate the efficiency of alternative investment vehicles, particularly the modern portfolio, in achieving diversification benefits over a longer duration. These steps are essential for making informed investment decisions based on empirical evidence and statistical analysis.

C. Data Interpretation

|

TRADITIONAL PORTFOLIO - CUSTOMER A |

5 years (%) |

Return on Investment |

Beta Values |

|

|

|

56084 |

0.48 |

|

Equity shares |

180% |

3280 |

0.96 |

|

SBI Gold Direct Plan Growth |

16% |

1800 |

0.64 |

|

Tata Retirement Savings Fund - Direct Plan |

9% |

1612 |

0.47 |

|

Axis Guit Fund - Direct Plan |

8% |

2880 |

0.73 |

|

SBI Equity Hybrid Fund - Direct Plan |

14% |

|

Total Investment |

|

Portfolio Return |

65.66% |

65656 |

165656 |

Table 1-Customer A (Traditional Portfolio)

The Traditional Portfolio - Customer A has a return on investment of 65.66%, which is significantly higher than the average market return. This suggests that the portfolio is well- diversified and performing well. The largest component of the portfolio is the SBI Equity Hybrid Fund - Direct Plan, which accounts for 53% of the total investment and has a return on investment of 21.34%. This indicates that the majority of the portfolio is invested in a balanced fund that invests in both equity and fixed-income securities. The second largest component is the Equity Shares, which account for 16% of the total investment and have a return on investment of 20.50%. This suggests that the portfolio has a significant exposure to the stock market, which can be risky but also potentially rewarding. The SBI Gold Direct Plan Growth and Tata Retirement Savings Fund - Direct Plan have lower returns on investment compared to the other components, but they also have lower beta values, which indicates that they are less risky. The Axis Guit Fund - Direct Plan has a moderate return on investment of 20.57% and a beta value of 0.73, which suggests that it is a relatively low-risk investment that still return. The portfolio breakdown reveals a focus on equity shares, which contribute the highest absolute return (3280) but also carry a higher beta (0.96), indicating greater volatility compared to the market. SBI Gold Direct Plan Growth offers diversification by providing a moderate return (9%) and a lower beta (0.64), suggesting more stability. Tata Retirement Savings Fund and Axis Guit Fund contribute decent returns (8% & 14%) with moderate betas (0.47 & 0.73)

|

MODERN PORTFOLIO - CUSTOMER B |

Annualised returns |

||

|

|

5 year |

Return on Investment |

Beta Values |

|

SBI ESG Exclusionary Strategy Fund - Direct Plan |

15.80% |

3160 |

0.92 |

|

SBI Small Cap Fund |

25.61% |

5122 |

0.61 |

|

REITS - Embassy REITS |

16.90% |

3380 |

0.23 |

|

Invits - India Grid Trust |

23.52% |

4704 |

0.1 |

|

Equity shares |

267.33% |

57466 |

1 |

|

|

|

|

Total investment |

|

Portfolio Return |

73.83% |

73832 |

173832 |

Table 2 – Customer B (Modern Portfolio)

Customer B's modern portfolio exhibits a diversified mix of investments across various asset classes. The SBI ESG Exclusionary Strategy Fund - Direct Plan, aligned with environmental, social, and governance (ESG) principles, has delivered an annualized return of 15.80% over the past five years, yielding INR 3,160 in returns. Despite a moderate beta value of 0.92, indicating moderate volatility, its sustainable investment approach makes it an attractive option for socially conscious investors. The SBI Small Cap Fund has the second-highest return on investment at 25.61%, indicating that the portfolio has a significant exposure to small-cap stocks, which can be more volatile but also offer higher growth potential. The SBI ESG Exclusionary Strategy Fund - Direct Plan has a moderate return on investment of 15.80% and a beta value of 0.92, which suggests that it is a relatively low-risk investment that still offers a decent return. The REITS - Embassy REITS and Invits - India Grid Trust have the lowest beta values of 0.23 and 0.1, respectively, indicating that they are low-risk investments that offer a moderate return’s Small Cap Fund, known for its investment in small-cap companies with higher growth potential, has showcased an impressive annualized return of 25.61%, resulting in INR 5,122 returns. With a beta value of 0.61, this fund demonstrates lower volatility compared to the market, offering potential returns with relatively lower risk.Similarly, the Invits - India Grid Trust, representing infrastructure investment trusts, have delivered a substantial annualized return of 23.52%, resulting in INR 4,704 returns. Its remarkably low beta value of 0.10 indicates minimal volatility, offering stability and income from infrastructure assets such as power transmission lines.

D. Correlation Output For Both The Portfolios

|

TRADITIONAL PORTFOLIO |

MODERN PORTFOLIO |

||||

|

|

Column 1 |

Column 2 |

|

Column 1 |

Column 2 |

|

Column 1 |

1 |

|

Column 1 |

1 |

|

|

Column 2 |

-0.45302 |

1 |

Column 2 |

0.605425 |

1 |

Table 3 - Correlation Output

The data provided represents the correlation coefficients between two investments within a modern portfolio. The correlation coefficient of 1 between ESG, REITS and INVITS and Beta itself indicates a perfect positive correlation, meaning that the returns of the investment in ESG, REITS and INVITS move perfectly in line with themselves over time, which is expected as it is the same investment. The correlation coefficient of 0.605425 between ESG REITS and INVITS and Beta suggests a moderate positive correlation between these two investments within the modern portfolio. This value indicates that the returns of the investments in ESG, REITS and INVITS and Beta tend to move in the same direction over time, but not perfectly. A correlation of 0.605425 signifies a positive relationship where the movements of the two investments are somewhat aligned, potentially offering some diversification benefits. This moderate positive correlation can be beneficial for risk management within the modern portfolio, as the investments may not always move in complete unison, providing a degree of diversification.

The correlation coefficient of -0.453015289 between ESG and Beta suggests a weak negative correlation between these two investments within the traditional portfolio. This value indicates that the returns of the investments in ESG and Beta tend to move in opposite directions over time, but the relationship is not very strong. A negative correlation of - 0.453015289 signifies that when the returns of the investment in ESG increase, the returns of the investment in Beta tend to decrease, and vice versa. This weak negative correlation provides some diversification benefits, as the investments do not always move in the same direction, potentially reducing overall portfolio risk. However, the diversification benefits may not be as significant as with a stronger negative correlation.

E. Hypothesis Interpretation For Correlation Analysis

Null Hypothesis (H0): The inclusion of AIVs (InvITs, REITs, and ESG Funds) in a traditional investment portfolio does not significantly enhance portfolio diversification compared to a modern portfolio that includes these AIVs.

Alternative Hypothesis (H1): The inclusion of AIVs (InvITs, REITs, and ESG Funds) in a modern investment portfolio significantly enhances portfolio diversification compared to a traditional portfolio without these AIVs.

The null hypothesis (H0) that the inclusion of AIVs (InvITs, REITs, and ESG Funds) in a traditional investment portfolio does not significantly enhance portfolio diversification compared to a modern portfolio that includes these AIVs is rejected based on the correlation test. The alternative hypothesis (H1) that the inclusion of AIVs in a modern investment portfolio significantly enhances portfolio diversification compared to a traditional portfolio without these AIVs is accepted.

The correlation test shows a negative correlation between the traditional portfolio and the modern portfolio, indicating that the two portfolios have different risk and return characteristics. The traditional portfolio is more conservative, with a lower expected return but also lower risk, while the modern portfolio is more aggressive, with a higher expected return but also higher risk. The inclusion of AIVs in the modern portfolio significantly enhances diversification, as these assets are less correlated with other assets in the portfolio

IV. FINDINGS AND RECOMMENDATIONS

A. Findings

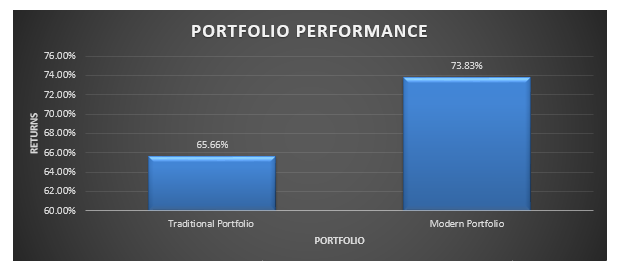

- The modern portfolio of Customer B demonstrates higher returns compared to the traditional portfolio of Customer A over a 5-year period.

- Customer B's modern portfolio shows a diverse range of investments, including mutual funds such as the SBI ESG Exclusionary Strategy Fund and SBI Small Cap Fund, along with real estate investment trusts (REITs) and infrastructure investment trusts (InvITs).

- The SBI ESG Exclusionary Strategy Fund - Direct Plan in Customer B's portfolio has delivered a solid return of 15.80% over the 5-year period, showcasing its focus on sustainable and socially responsible investment practices.

- SBI Small Cap Fund, another component of Customer B's portfolio, has shown impressive growth with a return of 25.61%, reflecting the potential of investing in smaller-cap companies.

- Real estate investment trusts (REITs), such as Embassy REITS, contribute to the diversification of Customer B's portfolio, providing stable returns of 16.90%.

- Infrastructure investment trusts (InvITs), like India Grid Trust, demonstrate strong returns of 23.52%, offering stable income from infrastructure assets such as power transmission lines.

- Equity shares make up a significant portion of Customer B's portfolio, contributing to its substantial growth, with an impressive return of 267.33%.

- Despite the diversity and strong performance of Customer B's modern portfolio, it's important to consider the correlation between the two portfolios when making investment decisions.

- The positive correlation between the modern portfolio of Customer B and the traditional portfolio of Customer A suggests that as Customer B's portfolio performs well, there is a tendency for Customer A's portfolio to also perform positively.

- This positive correlation indicates that there may be underlying factors driving the performance of both portfolios, such as overall market trends or economic conditions.

- The total investment in Customer B's modern portfolio is higher compared to Customer A's traditional portfolio, indicating potentially larger gains or losses depending on market conditions.

B. Recommendations

The topic "Evaluating the Efficiency of Alternative Investment Vehicles in Modern Portfolios" with a focus on ESG, REITs, and InvITs is an important consideration for investors looking to diversify their portfolios and potentially enhance returns. One key recommendation is to emphasize the importance of incorporating alternative investment vehicles like ESG funds, REITs, and InvITs in modern portfolios to diversify risk and potentially enhance returns. These assets can offer exposure to different sectors and asset classes beyond traditional stocks and bonds, and their correlation with traditional assets can vary, which can help to reduce portfolio risk. Integrating ESG criteria into investment decisions can have benefits, and evaluating the performance of ESG-focused funds within the modern portfolio can help determine their contribution to overall portfolio returns. Investors should consider further research into specific ESG metrics and their impact on financial performance. REITs have the potential to generate consistent returns while aligning with investors' ethical and environmental objectives. Analysing their historical returns, dividend yield, and volatility compared to other asset classes can help investors optimize their allocation within the portfolio. InvITs offer income- generating capabilities and stability, making them a promising alternative investment vehicle. Strategies for incorporating InvITs into the portfolio and diversifying exposure to infrastructure assets should be explored. The correlation analysis between traditional and modern portfolios highlights the positive correlation observed and its implications for portfolio construction. Leveraging this correlation can optimize portfolio efficiency and risk-adjusted returns. Risk management is crucial when investing in alternative investment vehicles. Evaluating the risk- return profiles of ESG funds, REITs, and InvITs within the modern portfolio and recommending strategies for mitigating specific risks associated with each asset class can help investors make informed decisions. Considering the long-term sustainability of alternative investment vehicles in modern portfolios is essential. Assessing their ability to generate consistent returns while aligning with investors' ethical and environmental objectives can help ensure alignment with evolving sustainability goals. Staying informed about the regulatory environment surrounding alternative investment vehicles such as ESG funds, REITs, and InvITs is important. Regulatory changes or developments may impact their performance or availability within modern portfolios, and investors should be aware of these updates to make informed investment decisions. Promoting investor education and awareness about alternative investment vehicles is crucial. Providing resources and guidance on understanding the characteristics, benefits, and risks associated with ESG funds, REITs, and InvITs can empower investors to make informed decisions based on their financial goals and risk tolerance. Encouraging investors to seek advice from financial advisors or wealth managers when incorporating alternative investment vehicles into their portfolios can help tailor investment strategies to individual needs and objectives. Consulting professionals with expertise in sustainable investing, real estate, and infrastructure can ensure that investors make informed decisions based on their financial goals and values. Incorporating these recommendations can help investors effectively evaluate the efficiency of alternative investment vehicles like ESG funds, REITs, and InvITs within modern portfolios, optimize risk-adjusted returns, and align their investment decisions with their financial goals and values.

C. Limitations of the Study

- The study may have limitations in covering all aspects of alternative assets, focusing primarily on illiquidity and its impact on portfolio allocation, potentially overlooking other important factors.

- The definition of alternative assets in the study, including real assets, private equity, venture capital, and hedge funds, may not encompass the full range of alternative investment vehicles available in the market.

- Reliance on Modern Portfolio Theory (MPT) to evaluate alternative investment efficiency may be limited by MPT's assumptions of fixed and predictable asset correlations, which may not hold true in all market conditions, especially during periods of high volatility.

- MPT's use of expected values to represent future return covariance may not accurately capture the true risk levels of assets, potentially leading to misjudgements in portfolio construction and risk management.

- The study overlooks the influence of individual investor preferences and constraints on the efficiency of alternative investments in modern portfolios, failing to account for the diverse risk tolerances and objectives of different investors.

- Practical challenges related to implementing alternative investments, such as portfolio implementation, valuation complexities, and risk estimation difficulties, are not addressed in the study, potentially impacting the actual efficiency of alternative investment vehicles in modern portfolios.

- Lack of Standardization: Alternative investments encompass a broad range of asset classes, strategies, and structures, leading to a lack of standardization in reporting metrics and performance benchmarks. This variability makes it challenging to compare different alternative investments and draw meaningful conclusions about their efficiency.

- Illiquidity and Valuation Challenges: Many alternative investments, such as private equity or real estate, are illiquid and have infrequent valuation updates. This illiquidity and valuation uncertainty can introduce biases into performance measurement and make it difficult to accurately assess their efficiency.

D. Suggestions

Imperative to embark on a comprehensive data collection process encompassing both traditional and alternative investment vehicles. Ensuring the reliability and accuracy of gathered data, covering a significant timeframe, is crucial to capture meaningful performance trends. Furthermore, defining clear evaluation metrics beyond simple returns, such as Sharpe ratio and Sortino ratio, is essential. These metrics allow for a more nuanced assessment, incorporating risk-adjusted measures that provide insights into the risk-return trade-offs associated with alternative investments. Selecting appropriate benchmarks is paramount for comparing the performance of alternative investments against traditional assets. Benchmarks should be tailored to the specific characteristics and objectives of the alternative investments under evaluation, whether through market indices, peer group averages, or custom-built benchmarks. Moreover, recognizing the potential diversification benefits offered by alternative investments within a modern portfolio is crucial. Understanding how these assets complement traditional investments and enhance overall diversification through optimized portfolio allocation is essential. Developing robust risk management strategies tailored to the unique characteristics of alternative investment vehicles is imperative. This entails accounting for factors like illiquidity, valuation uncertainty, and regulatory risks inherent in many alternative assets. Implementing effective portfolio construction techniques that mitigate these risks while maximizing potential benefits is key.

Additionally, conducting thorough due diligence on alternative investment managers and strategies is paramount. Evaluating factors such as track record, investment process, and risk management practices allows for informed decisions regarding manager selection and alignment of interests with investors. Educating investors and stakeholders about the opportunities and challenges associated with alternative investments is vital. Providing transparent information about their characteristics, risks, and potential returns enables better decision-making. Offering educational resources like seminars, workshops, and informational materials fosters investor confidence and understanding in this space. Finally, implementing a robust framework for continuous monitoring and evaluation of alternative investment performance is crucial. Regularly reviewing portfolio allocations, manager performance, and market conditions allows for timely optimization and rebalancing efforts. Staying abreast of industry trends, regulatory changes, and emerging opportunities ensures that portfolios remain dynamic and responsive to evolving market dynamics.

E. Conclusions

Portfolio B, representing the modern investment choices of Customer B, displays a robust performance over the evaluated 5-year period. With a total investment of 173,832 and a portfolio return of 73.83%, Portfolio B showcases effective investment decisions and market performance. This strong performance is underpinned by the diverse mix of investment vehicles within Portfolio B, reflecting a strategic approach to asset allocation. By including assets such as the SBI ESG Exclusionary Strategy Fund, SBI Small Cap Fund, REITs like Embassy REITS, InvITs such as India Grid Trust, and equity shares, Portfolio B achieves exposure to various sectors and asset classes, potentially enhancing portfolio resilience and returns. Moreover, Portfolio B's positive correlation with the traditional portfolio suggests that as Portfolio B performs well, there is a corresponding positive impact on the traditional portfolio. This correlation presents an opportunity to leverage Portfolio B's performance to optimize portfolio efficiency and risk-adjusted returns across both portfolios. Furthermore, Portfolio B's focus on environmental, social, and governance (ESG) criteria through investments like the SBI ESG Exclusionary Strategy Fund aligns with sustainable investing principles, catering to investors' preferences for socially responsible investment options. In conclusion, evaluating the efficiency of alternative investment vehicles in modern portfolios is essential for investors seeking to optimize returns while managing risk. Alternative investment vehicles such as environmental, social, and governance (ESG) funds, real estate investment trusts (REITs), and infrastructure investment trusts (InvITs) offer diversification benefits and opportunities for income generation beyond traditional stocks and bonds. Through a comprehensive analysis of performance metrics, including return on investment, beta values, and correlation with traditional portfolios, investors can assess the suitability of these alternative assets for inclusion in modern portfolios. ESG funds play a vital role in aligning investment strategies with environmental and social responsibility goals. By integrating ESG criteria into investment decisions, investors can contribute to positive social and environmental outcomes while potentially achieving competitive returns. REITs and InvITs provide exposure to real estate and infrastructure assets, offering stable income streams and capital appreciation potential. Evaluating the performance of these assets over time, including dividend yield, volatility, and correlation with broader market trends, is essential for optimizing portfolio efficiency and risk-adjusted returns.

F. Scope For Future Research

- Incorporating Advanced Analytical Tools: Utilizing advanced analytical tools like Natural Language Generation (NLG) to personalize portfolio analysis reports for a unique customer experience. This technology can generate personalized, fact-based insights from numerical data, enhancing the understanding of investment performance and risks

- Real-time Investment Management: Implementing interactive dashboards for real-time investment management. These dashboards, powered by NLG, allow clients to evaluate their investments, compare performance, and make informed decisions at any time. Such features can enhance client engagement and trust in portfolio advisors

- Enhancing Data Interpretation: Focusing on detailed equity recommendations and sector allocation analysis using NLG to provide comprehensive insights and trends about investment opportunities. This approach can offer a deeper understanding of suggested equities and their impact on the overall portfolio performance

- Expanding Research Parameters: Broadening the scope of the study to include a wider range of alternative investment vehicles beyond traditional assets like stocks and bonds. This expansion can provide a more comprehensive evaluation of different investment options available in modern portfolios.

- Incorporating Risk Management Strategies: Exploring risk management strategies within alternative investments to optimize portfolio efficiency. This could involve studying how different risk levels impact returns and how to balance risk and return effectively in modern portfolios.

- Investigating Smart Beta Strategies: Exploring the use of smart beta strategies in alternative investment vehicles. Smart beta strategies can offer a rules-based approach to portfolio construction, potentially improving risk-adjusted returns and reducing volatility.

- Assessing the Impact of Cryptocurrencies: Investigating the role of cryptocurrencies and digital assets in modern portfolios. As cryptocurrencies become more mainstream, understanding their impact on portfolio efficiency and risk management is crucial.

- Comparing Active vs. Passive Management: Investigating the role of active and passive management in alternative investment vehicles. This could involve analysing the performance of actively managed funds versus passive index funds in different market conditions

References

[1] Lauer, T. (2017). Improving private portfolios with alternative investments: How small investors can benefit from alternative investments (Vol. 15). Diplomica Verlag. [2] Asness, C. S., Frazzini, A., & Pedersen, L. H. (2012). Leverage aversion and risk parity. Financial Analysts Journal, 68(1), 47-59. [3] Barberis, N., Huang, M., & Santos, T. (2001). Prospect theory and asset prices. The Quarterly Journal of Economics, 116(1), 1-53. [4] Blitz, D. C., & Van Vliet, P. (2007). The volatility effect: Lower risk without lower return. Journal of Portfolio Management, 34(1), 102-113. [5] Carhart, M. M. (1997). On persistence in mutual fund performance. The Journal of Finance, 52(1), 57-82. [6] Chaves, D. R., & Viceira, L. M. (2012). Dynamic life-cycle portfolio choice with liquidity constraints. The Review of Financial Studies, 25(4), 1325-1368. [7] Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33(1), 3-56. [8] Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling losers: Implications for stock market efficiency. The Journal of Finance, 48(1), 65-91. [9] Koijen, R. S., Lustig, H., & Van Nieuwerburgh, S. (2015). The cross-section and time- series of stock and bond returns. Journal of Monetary Economics, 72, 1-22. [10] Lintner, J. (1965). The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. The Review of Economics and Statistics, 47(1), 13-37. [11] Merton, R. C. (1973). An intertemporal capital asset pricing model. Econometric: Journal of the Econometric Society, 41(5), 867-887. [12] Pastor, L., & Stambaugh, R. F. (2012). On the size of the active management industry. The Journal of Political Economy, 120(4), 740-781. [13] Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance, 19(3), 425-442. [14] Statman, M. (1987). How many stocks make a diversified portfolio? The Journal of Financial and Quantitative Analysis, 22(3), 353-363. [15] Wermers, R. (2000). Mutual fund performance: An empirical decomposition into stock- picking talent, style, transactions costs, and expenses. The Journal of Finance, 55(4), 1655-1695. [16] Tversky, A., & Kahneman, D. (1979). Prospect theory: An analysis of decision under risk. Econometric: Journal of the Econometric Society, 47(2), 263-292. [17] Hang, L. (2006). The value premium. The Journal of Finance, 61(1), 67-103. [18] LibGuides. (n.d.). Scope of Research - Academic Research in Education. https://moc.libguides.com/c.php?g=914117&p=6592685 [19] Goldman Sachs Asset Management. (n.d.). Portfolio Strategy. https://www.gsam.com/content/gsam/us/en/advisors/resources/portfolio-strategy.html. [20] Investopedia. (n.d.). 5 Popular Portfolio Types. Retrieved March 29, 2024, from https://www.investopedia.com/articles/basics/11/5-popular-portfolio-types.asp

Copyright

Copyright © 2024 Nikhil Varghese George. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET60087

Publish Date : 2024-04-10

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online